Sun’s Up to Sum Up

Global payments company SumUp has launched in Australia and its headquarters have been purposely located in the best part of the nation, right here on the Sunshine Coast. Bec Marshall talks to the man at the helm about growth plans, the fintech boom and what’s in it for local small business.

When Malcolm Areington was put in charge of launching global fintech company SumUp in Australia, he thought Sydney was the best place to be.

It didn’t take long before fond memories of holidays to Noosa and a yearning for the Sunny Coast lifestyle triggered new thinking and a bold move north.

“I’ve got a love for Noosa and the Sunshine Coast,” Malcolm says. “We’ve been coming here for a long time; we have family here and it’s always been a destination for us.

“I am South African by birth and I have lived in London and Asia, but this place is beautiful. It’s like a cleaner, safer South Africa and it’s just a great lifestyle, with the water and the sunshine. We are so blessed to live here.

“I was fortunate that the Australian government awarded me permanent residency as part of the global talent visa, because of my skills in fintech, so I decided to make my home in Noosa.

“We have plans of building our team here on the Sunshine Coast and I felt that if I was in Queensland, that allowed me to look at top universities and within the working environment to find good talent.

“I was originally in Sydney, but I quickly realised that if SumUp wanted the opportunity to have top-grade talent, I’d have to come out of New South Wales and Victoria. Fintech is definitely growing in Queensland and there’s a real push to create regional hubs.”

Malcolm said that being based here also meant they could offer a lifestyle that attracted and supported good talent.

So, what exactly is SumUp?

It is a private company that was founded in the UK in 2012 offering point-of-sale payment devices.

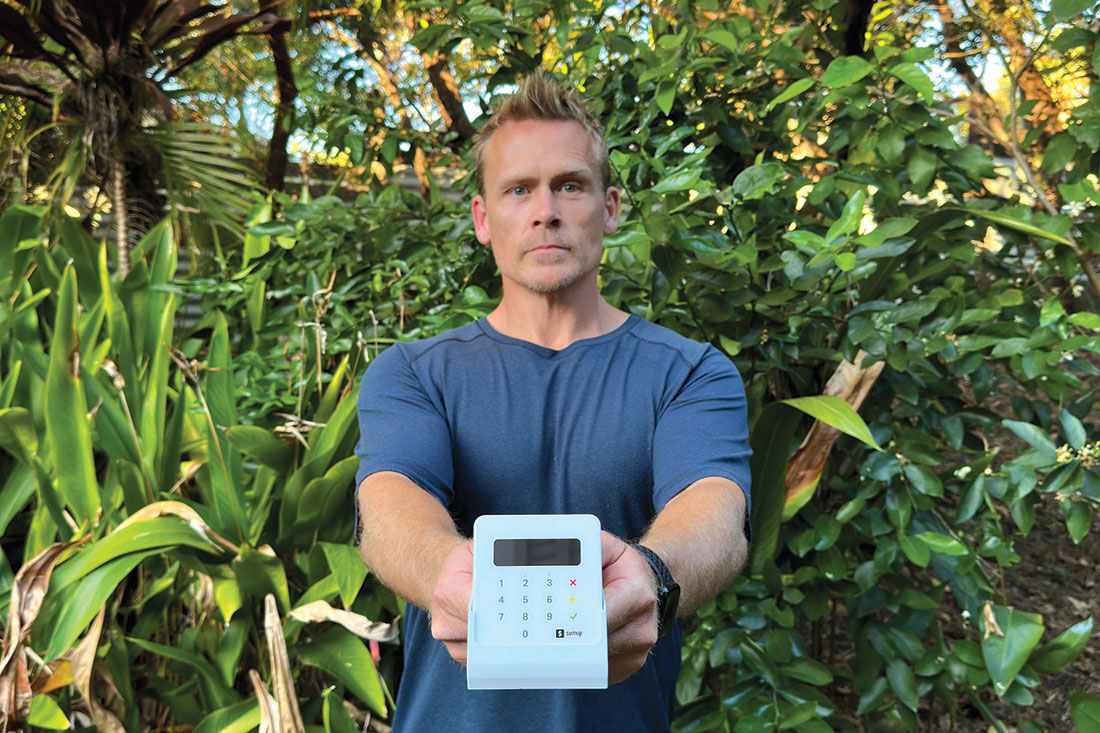

Its mission is to empower small businesses and entrepreneurs with affordable and easy-to-use payment solutions including the Air Card Reader to suit every business.

SumUp has expanded its reach across the globe since 2012 and is now serving millions of merchant customers in

35 countries including in Europe, Latin America and North America. Australia is market number 36.

“Australia has always been on the strategic roadmap for SumUp,” Malcolm says. “Once we have a sound base here, then we can scale a slightly different solution into Asia. It’s a different, faster market there, and we could potentially use Australia as a regional hub for the Asia Pacific.”

SumUp devices can be used across any type of business sector, however its target customers are small, micro and nano merchants up to mid-tier SMEs who want to accept payments online or in person, via the tap of a phone or card.

“We want to be able to give merchants a choice outside of the traditional banks and other competitors within the market,” Malcolm says. “There hasn’t been enough choice for customers to make a sound decision.

“If someone has a Sunday market stall or a food and beverage business or a freelancing side hustle, we allow them to accept payment with a SumUp device that connects seamlessly to their phone, iPad or tablet.”

Malcolm said SumUp’s point of difference was the transparency on pricing and the cost of the device.

“We offer merchants a simple, accessible and inexpensive way to accept payments,” he said. “We think we’ve found the sweet spot of a once-off fee for a device and a flat fee of 1.75% per transaction, irrespective of what cards you use.

“Our competitors have been in the market for 10 years. We’re a late entrant to the market here in Australia and we accept that, but all we want to do is demonstrate the value and reassurance of our brand and give consumers greater choice.”

Devices are available on Amazon, the SumUp website and soon to be other channels in Australia.

Malcolm praises the 150-strong overseas team from SumUp who worked to “get Australia up and running” while he managed meetings at all hours across multiple time zones.

He’s appreciated being able to offset those long working hours with walks along Noosa River with his wife Charissa and their French bulldogs, Blue and Daisy.

Malcolm’s professional background is diverse, to say the least. He has played rugby internationally and worked in confectionery and building materials. But he has a passion for payments.

“I’ve been working in fintech and payments for 14 years,” he said. “It has evolved so quickly in that time and is dynamic and forever changing.

“As a consumer, you don’t realise the complexity behind the simple action of tapping your card. The technical work that goes into it and the regulatory landscape that allows that payment is unbelievably complex.

“There are interactions between the bank issuer, card schemes, the merchant and customer and it has to happen seamlessly within a split second.

“The world moves around money and of course, payments are a massive part of that. If payments don’t happen between a buyer and a seller, nothing occurs.

“That’s why I’ve been in payments for so long. SumUp plays a crucial role in keeping the world of commerce turning.”